Property Tax Arkansas

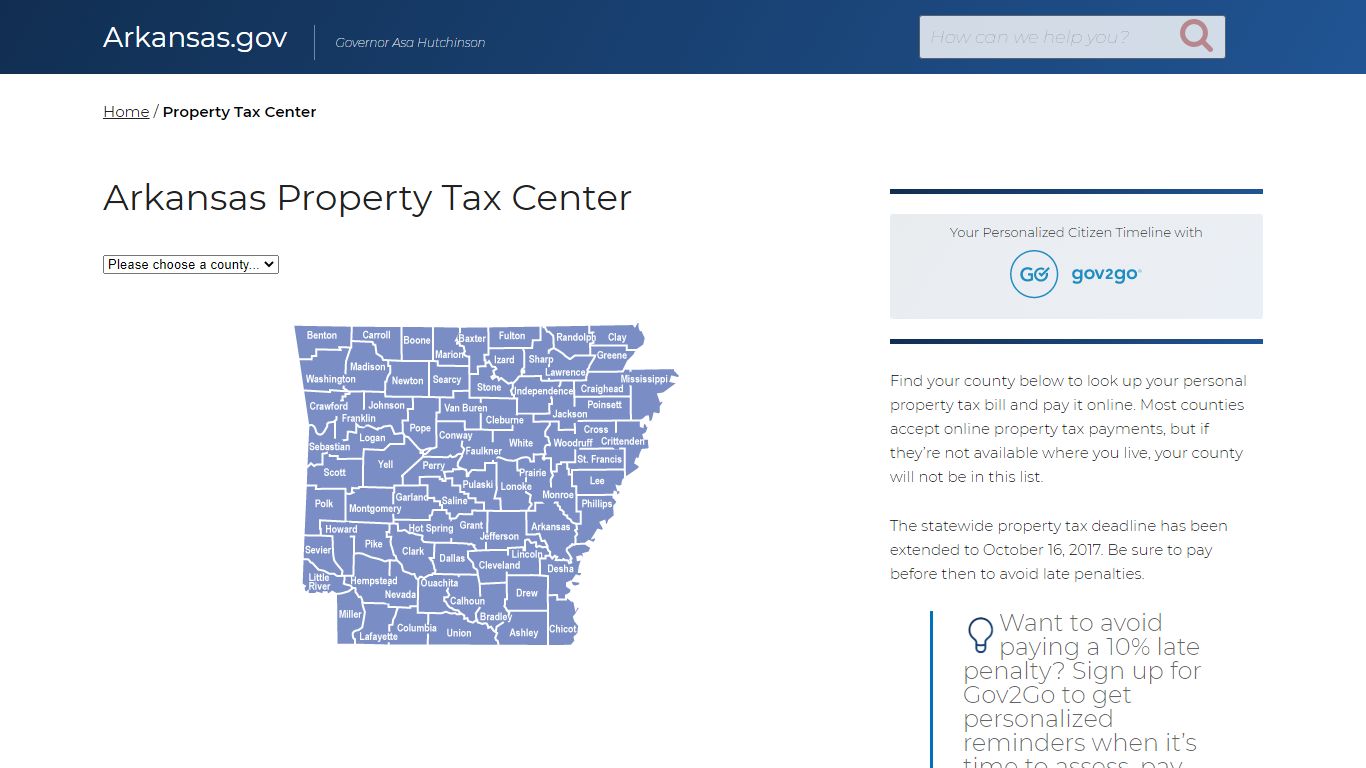

Property Tax Center - Arkansas.gov

Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax. Online payments are available for most counties. Want to avoid paying a 10% late penalty? Sign up for Gov2Go to get personalized reminders when it’s time to assess, pay property taxes and renew your car tags.

https://portal.arkansas.gov/property-tax-center/

Assess & Pay Property Taxes - Arkansas.gov

Assess & Pay Property Taxes - Arkansas.gov The Official Website of the State of Arkansas Assess & Pay Property Taxes Locate contact information for your county assessor and tax collector. What can we help you with? Frequently Asked Questions Get instant answers to hundreds of questions about government services.

https://portal.arkansas.gov/popular_services/assess-pay-property-taxes/

Arkansas Property Taxes By County - 2022 - Tax-Rates.org

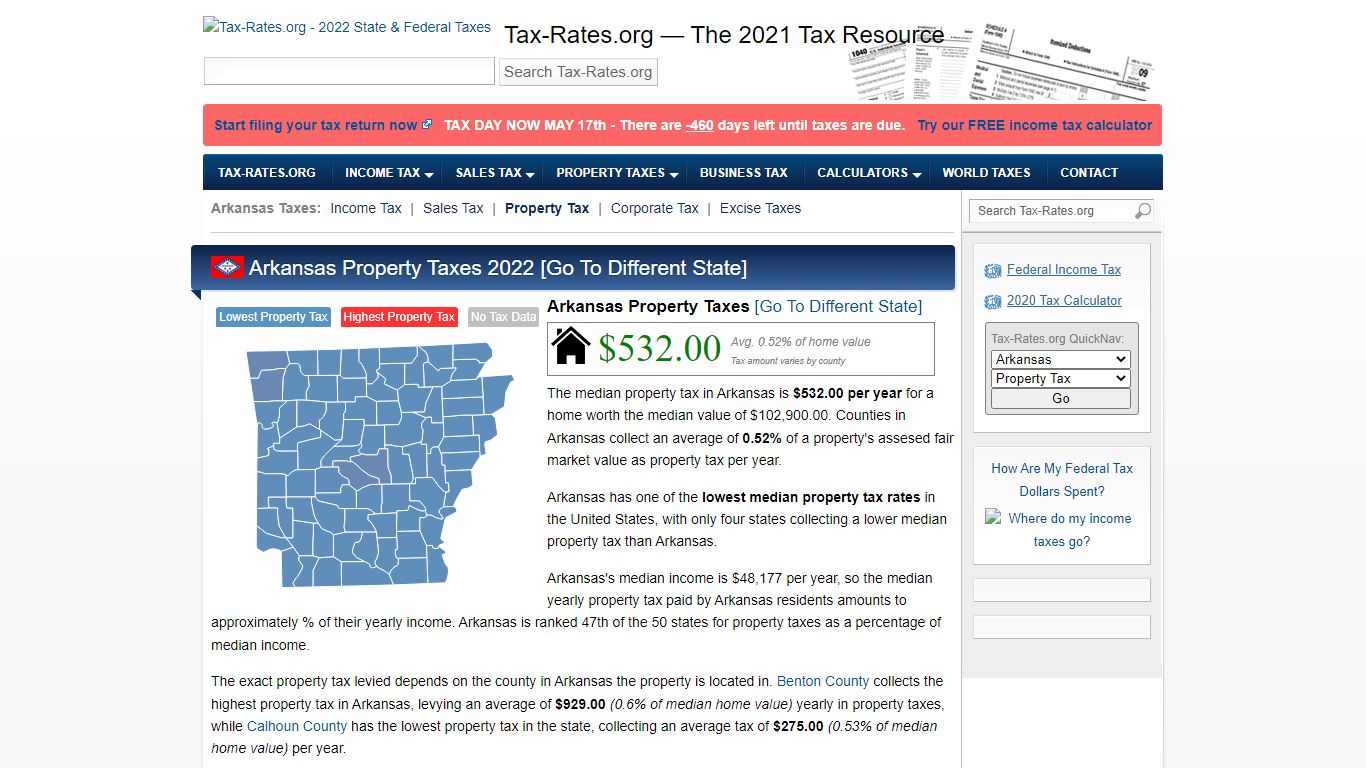

Arkansas Property Taxes [Go To Different State] $532.00 Avg. 0.52% of home value Tax amount varies by county The median property tax in Arkansas is $532.00 per year for a home worth the median value of $102,900.00. Counties in Arkansas collect an average of 0.52% of a property's assesed fair market value as property tax per year.

https://www.tax-rates.org/arkansas/property-tax

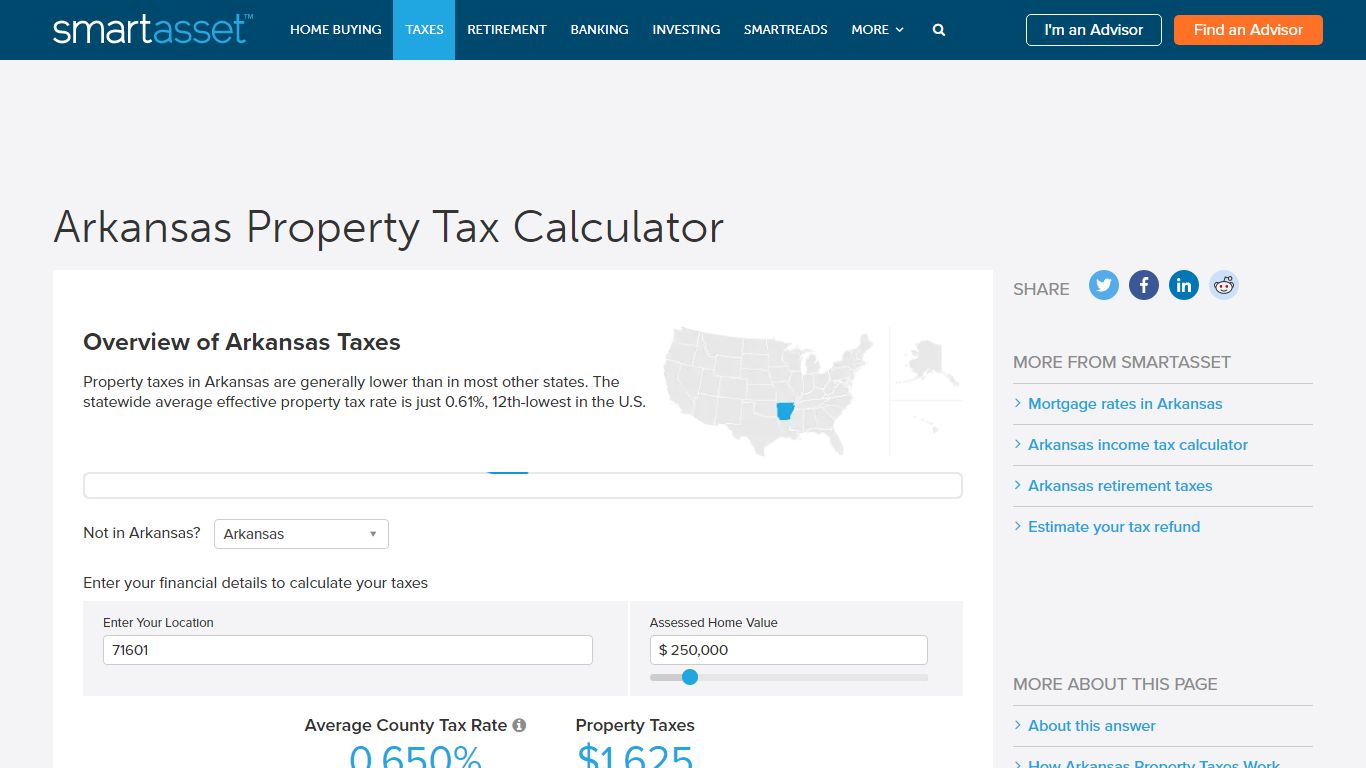

Arkansas Property Tax Calculator - SmartAsset

Arkansas Property Tax Calculator - SmartAsset Calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Compare your rate to the Arkansas and U.S. average. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators

https://smartasset.com/taxes/arkansas-property-tax-calculator

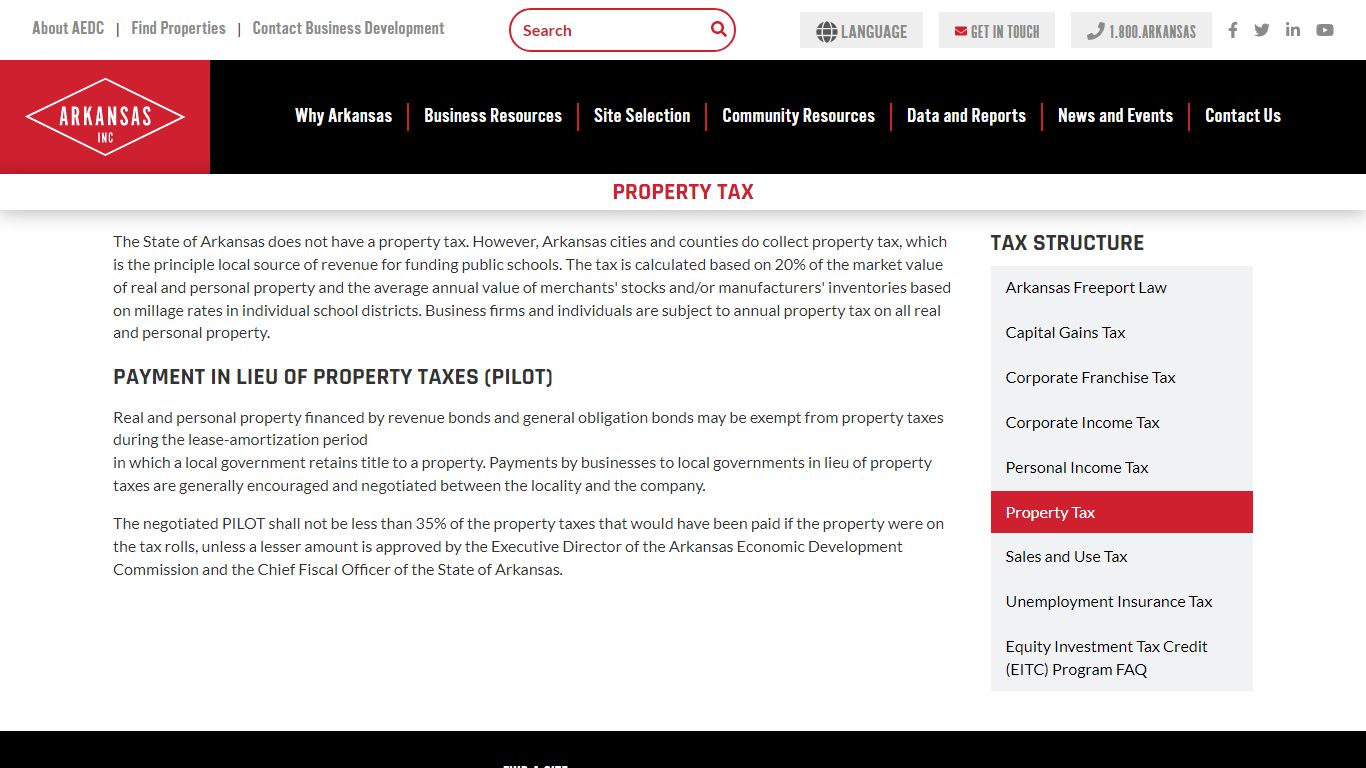

Property Tax Rates in Arkansas | AEDC

Property Tax The State of Arkansas does not have a property tax. However, Arkansas cities and counties do collect property tax, which is the principle local source of revenue for funding public schools.

https://www.arkansasedc.com/why-arkansas/business-climate/tax-structure/property-tax

Arkansas Property Tax Center | Arkansas.gov

Find your county below to look up your personal property tax bill and pay it online. Most counties accept online property tax payments, but if they’re not available where you live, your county will not be in this list. The statewide property tax deadline has been extended to October 16, 2017. Be sure to pay before then to avoid late penalties.

http://www.beta.arkansas.gov/pages/property-tax-center/

How do I pay personal property taxes? - Arkansas.gov

Pay Franchise Taxes; INA Subscriber Account; Search All Services; Citizens. Driver & Motor Vehicle Services; Property Tax Center; Offender Banking; County Government Services; AR Taxpayer Access Point (ATAP) Voter Information; Unclaimed Property; Criminal Background Check; Medical Marijuana *11 Services; Search All Services; Children & Family ...

https://portal.arkansas.gov/faqs/how-do-i-pay-personal-property-taxes/

Ultimate Arkansas Real Property Tax Guide for 2022 - Direct Tax Loan

Overall, there are three stages to real property taxation, namely: establishing tax rates, appraising property worth, and then bringing in the tax. Under Arkansas law, the government of your city, public schools, and thousands of various special purpose units are authorized to appraise housing market value, fix tax rates, and levy the tax.

https://directtaxloan.com/guides/property-tax-ar/

Taxes | Department of Finance and Administration - Arkansas

Log into the Arkansas Motor Carrier System to generate an IFTA tax report. Local Tax Rate Lookup Look up excise taxes by address and zip code to determine your local tax rate. Pay Your Personal Property Taxes Online Find your county, look up what you owe and pay your tax bill online in most counties. Suspicious Tax Activity Reporting

https://www.dfa.arkansas.gov/services/category/taxes/

Welcome! - ARCountyData.com

Welcome. ARCountyData.com is the fastest and easiest way to access Arkansas county property information. From the convenience of your office or home you can research property sales histories, commercial and residential building descriptions, and legal descriptions.. These are the counties currently served by this site.

https://www.arcountydata.com/Arkansas Property Tax County Map

State Summary Tax Assessors. Arkansas has 75 counties, with median property taxes ranging from a high of $929.00 in Benton County to a low of $275.00 in Calhoun County. For more details about the property tax rates in any of Arkansas' counties, choose the county from the interactive map or the list below. To view all county data on one page ...

https://www.propertytax101.org/arkansas